5 Excellent Startup Tips on Securing a Bank Loan

It’s no secret that securing bank funding for your startup is difficult these days – but it’s not impossible. Give yourself better odds with these 5 simple Startup tips: Write a clear and convincing business plan. Business owners must build a strategy from the very beginning around being “lendable,” so a business plan helps lay […]

Why To Take Caution With Investor “Finders”

There are many service providers that offer to help startups with attracting investors, colloquially referred to as “finders.” While they prefer to be called business brokers or consultants, most finders are either CPAs, insurance brokers, retired executives, or former entrepreneurs. They mostly operate in the Angel landscape, targeting deals between $100K to $2M. Typically, they […]

7 Reasons Why Hera Venture Summit Is A Must Attend Startup Event

On Aug 4, 2015 The White House, Tech Giants, Entrepreneurs, and Venture Capitalists across America committed to invest in the future of women in business. A commitment that set the stage for previously untapped opportunities for female founders. Leading the forefront of female entrepreneurship is the conglomeration of Hera Hub= Female focused Co-working Space Hera […]

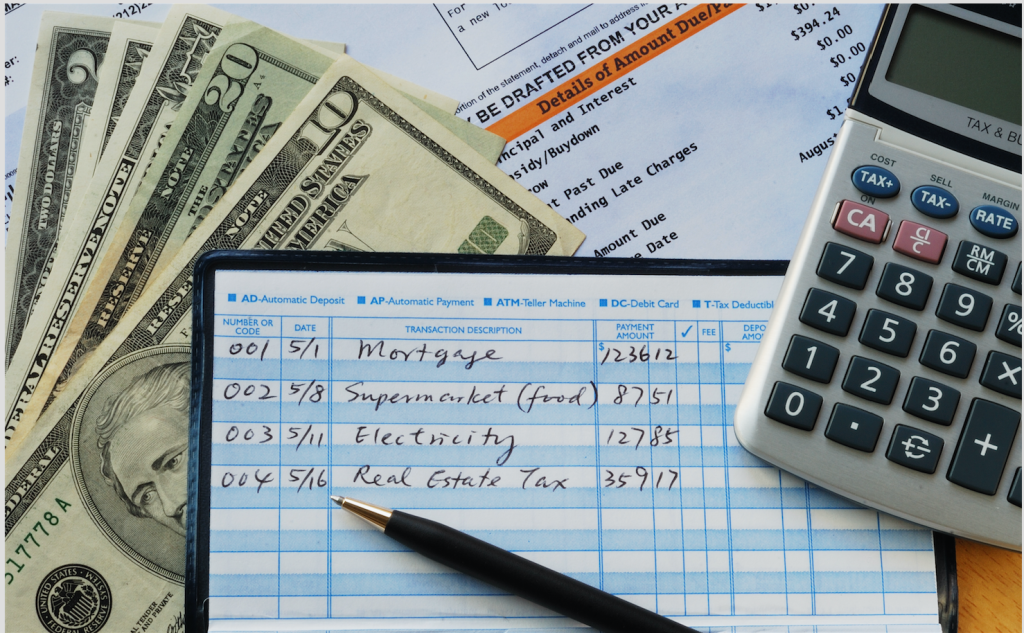

The Importance of Bookkeeping for a Startup Business

Bookkeeping, by definition, is the process of recording a company’s financial transactions and history. It is the first step in the broader accounting process which involves reporting and analyzing data to make business decisions. Many entrepreneurs find that they are wearing too many hats as it is and they just don’t have time to dedicate […]

7 Lessons Learned From A Vegas Tech Startup Conference

“ It’s A different kind of Vegas.” Collision Conference invaded and innovated downtown Las Vegas, Nevada Cinco De May and 6th. The 48 hour “crash course” included 7500 attendees representing 89 different countries, with a legendary guest-list that included: 200 WorldClass Speakers, 1000 Startup Businesses, 451 Tech Investors, and countless “smart” entrepreneurs. Equally as interesting […]

The Correlation between A Startups Seed Round and Series A Round

Here at The Startup Garage we are often asked, “Has it become harder to raise capital for Startups nowadays?” The answer is, yes and no. On the one hand, the total dollars invested in U.S. startups in 2014 reached its highest point since the dot-com boom in 2000, according to Bloomberg. On the other […]

Where to Meet Venture Capitalists?

As a Startup Entrepreneur stepping outside of your comfort zone is a daily norm, especially in the search of funding for your business. Scoring a meeting with a Venture Capitalist becomes a network juggling act between strategy and innovation. A key point to remember when approaching VC’s is that the question always on the top […]

How To Determine Market Traction For Your Startup

The major thing to know about the first few years of funding a startup business is that in order to attract investor capital you must accomplish certain milestones. Accomplishing milestones helps to reduce the risk associated with the startup venture. Investors are constantly assessing risk when evaluating a startup and obviously prefer those that assume […]

Rocket Growth in Venture Investment Activity for 2014

Rocket Growth in Venture Investment Activity for 2014 Look at the data, and you’ll go “Wow.” According to TechCrunch, Forbes and other sources venture capitalist investments are shooting through the roof. Investments in new startups rose to almost $6 billion, up from $3.5 billion for the same period last year. This could mean that venture […]

What Startups Got Funded In May?

May Monthly Startup Wrap-up. Find Out Who Got Funded and What Type Of Deals Are Attracting Investment here: May 1st Bookbub the bargain bin for ebooks, secured $3.8 million in it’s first round of funding. May 3rd Waggl the startup survey app inspired by honeybees, secured $1 millionin funding. May 5th Automattic which runs WordPress.com, […]