Here at The Startup Garage we are often asked, “Has it become harder to raise capital for Startups nowadays?”

The answer is, yes and no.

On the one hand, the total dollars invested in U.S. startups in 2014 reached its highest point since the dot-com boom in 2000, according to Bloomberg. On the other hand, there are more startups competing for these dollars than ever before.

One of the hardest rounds to raise, and subsequently one of the biggest hurdles to startup success, is the Seed round. This round is potentially the riskiest round for an investor as most startups raising Seed capital have yet to accomplish any significant milestones that prove the concept.

The technology or product development is usually in its infancy,

The team is lacking,Traction is nominal if present at all, and The key benchmarks for success have yet to be proven. As a result, many good ideas never make it out of the gate.

Those that successfully navigate the Seed round significantly increase their chance at entrepreneurial success and at raising their next round of capital, the Series A round.

When raising a Seed round the question becomes, “How large of a seed round should I raise to maximize my chances of raising a Series A round?”

Smaller Seed rounds seem like a quick fix because they are simpler and faster to raise as they typically require less investors.

However, in order to raise a significant Series A round, the startup needs sufficient capital to accomplish enough milestones that will attract Series A investors. As a result, we see a direct correlation between the amount of capital raised in the Seed round and the amount of capital raised in the subsequent Series A round.

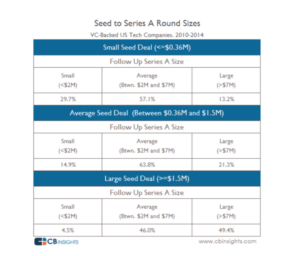

According to data from CB Insights, companies that raised both a Seed round and a Series A round can be categorized as follows:

- Small – Below the 25th percentile (<$360K for Seed, <$2M for Series A)

- Average – Between 25th and 75th percentile (between $260K and $1.5M for Seed, between $2M and $7M for Series A)

- Large – Above 75th percentile (>$1,5M for Seed, >$7M for Series A)As depicted in the chart below, nearly half of all large Seed deals became large Series A deals. Most of the other large Seed deals went on to raise average Series A rounds with a small number raising a small Series A round.

For companies that raised small Seed rounds, 57% went on to raise an average Series A round, and only 13% raised Series A rounds of $7M+. Lastly, 63.8% of companies that raised an average Seed round went on to raise an average Series A round.