5 Reasons to Attend The USD V2 Pitch Competition For Entrepreneurs

On Thursday April 28th University of San Diego School of Business will hold an exciting competition in a “Shark Tank” like setting. Top student entrepreneurs from USD and Tijuana will compete for a total of $100,000 in cash and invaluable mentorship and support. The Startup Garage Team Compiled The Top 5 Reasons this is a […]

Crowdfunding For Equity: Title III and Equity Crowd Funding 101

What is Equity Crowdfunding? Equity crowdfunding is on the rise after the signing of the Jumpstart Our Business Startups (JOBS) Act was signed by President Obama in April 2012. Simply put, it is a type of crowdfunding that enables broad groups of investors to fund startup companies and small businesses in return for equity. Three […]

Why To Take Caution With Investor “Finders”

There are many service providers that offer to help startups with attracting investors, colloquially referred to as “finders.” While they prefer to be called business brokers or consultants, most finders are either CPAs, insurance brokers, retired executives, or former entrepreneurs. They mostly operate in the Angel landscape, targeting deals between $100K to $2M. Typically, they […]

Furry Innovation: Pets Are Startup Businesses New Best Friends

It’s no denying it, we love our pets and we’re willing to spend countless amounts of money in order to enhance their health, happiness, and even appearance. According to the American Pet Products Association an estimated $58.5 billion was spent on pets in 2014. With nearly $330 million on pet costumes for Halloween alone. From […]

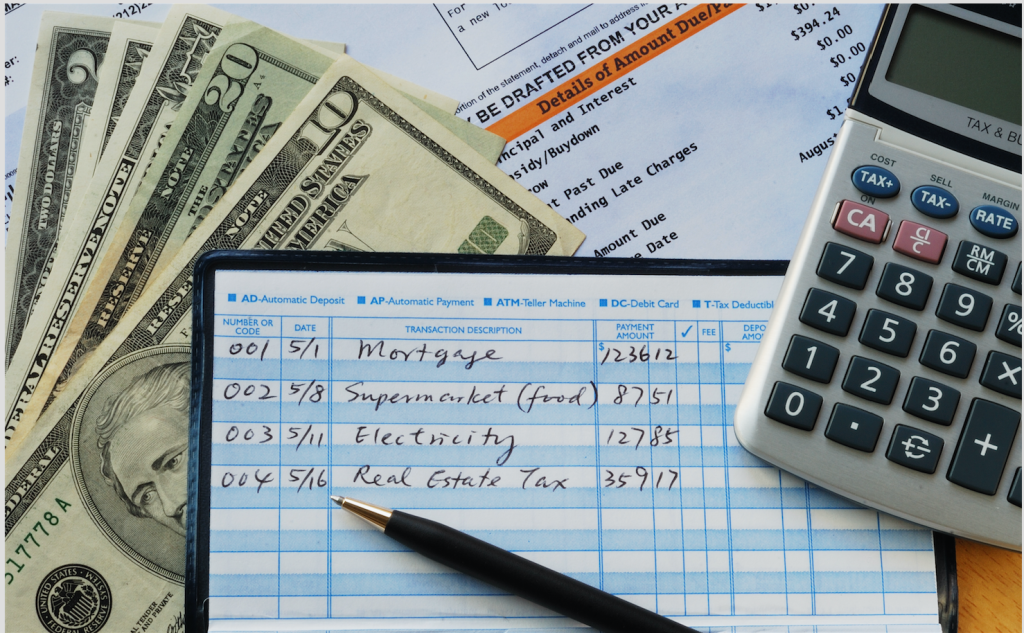

The Importance of Bookkeeping for a Startup Business

Bookkeeping, by definition, is the process of recording a company’s financial transactions and history. It is the first step in the broader accounting process which involves reporting and analyzing data to make business decisions. Many entrepreneurs find that they are wearing too many hats as it is and they just don’t have time to dedicate […]

SEC Oks Equity Crowdfunding with Regulation A+ Changes to the JOBS Act

On March 25, 2015 the SEC amended Regulation A, commonly referred to as Reg. A+, to further implement Title IV of the JOBS Act. The amended regulation seeks to create an environment where emerging enterprises can efficiently raise public capital through crowdfunding. Historically, Reg A has not been widely used for two reasons: 1) the […]

7 Lessons Learned From A Vegas Tech Startup Conference

“ It’s A different kind of Vegas.” Collision Conference invaded and innovated downtown Las Vegas, Nevada Cinco De May and 6th. The 48 hour “crash course” included 7500 attendees representing 89 different countries, with a legendary guest-list that included: 200 WorldClass Speakers, 1000 Startup Businesses, 451 Tech Investors, and countless “smart” entrepreneurs. Equally as interesting […]

The Correlation between A Startups Seed Round and Series A Round

Here at The Startup Garage we are often asked, “Has it become harder to raise capital for Startups nowadays?” The answer is, yes and no. On the one hand, the total dollars invested in U.S. startups in 2014 reached its highest point since the dot-com boom in 2000, according to Bloomberg. On the other […]

Startup Business Funding Report 2014

The past year has been an eventful one for Startup Businesses in their quest to raise capital. Venture Capitalists, Angel Investors, and Peer-to-Peer Crowdfunding soared in 2014, breathing new life into uncertain economy. Venture Capital Roundup According to the PitchBook Platform 88 billion dollars in venture capital was infused into the global economy in 2014. […]

Angel Investments Soar in the U.S. Along with the Tech Coast Angels

The Q1 2014 Halo Report was released recently by the Angel Resource Institute, Silicon Valley Bank and CB Insights In a collaborative effort to raise awareness of early-stage investment activities by angel investors the Halo Report researches and analyzes angel investment activities and trends in North America. This quarter’s report card will one most investors […]