TSG’s Highlights from the Connection Innovation Report: San Diego

CONNECT, a San Diego non-profit helping to create and scale innovation companies, assists entrepreneurs by providing resources that allow them to grow their business. Since 2005, they have measured the growth in economic innovation in San Diego. We highlighted the key findings of the report to showcase the advancement of San Diego’s entrepreneurial growth. We […]

How Does A Convertible Note Works For Startups?

A convertible note is an investment instrument intended to provide a startup company with early stage financing. It’s a compromise of sorts, blending the downside protection associated with a loan and capturing the upside potential of selling equity shares. Why are they used? It can be very difficult for investors and entrepreneurs to agree on […]

How To Understand Customer Lifetime Value and Customer Acquisition Costs?

The Key to Profitability for your business Understanding customer lifetime value and customer acquisition costs. It comes as no surprise that a company must earn more revenue over the lifetime of any given customer (referred to as Customer Lifetime Value or CLTV) than it costs to acquire the customer (referred to as Customer Acquisition Cost […]

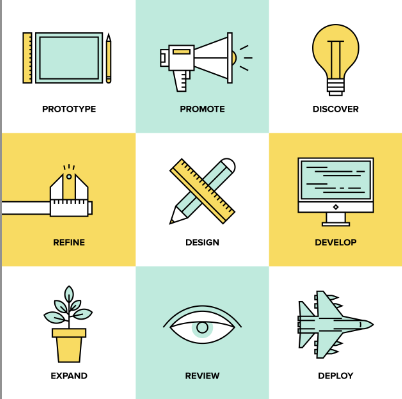

How To Measure and Achieve Product/Market Fit

Product/Market Fit is a term that was coined to define the process of creating a product that resonates with a specific target market(s). Taking this definition a step further, Product/Market Fit is proving sufficient demand within a target market segment to justify the spending of capital (human and financial) in order to begin scaling the […]

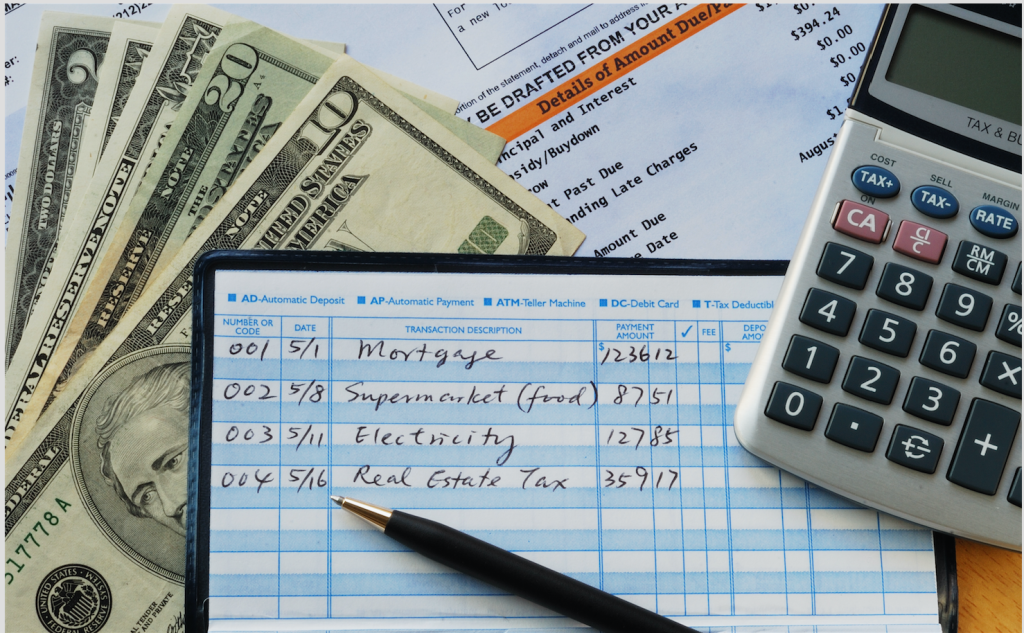

The Importance of Bookkeeping for a Startup Business

Bookkeeping, by definition, is the process of recording a company’s financial transactions and history. It is the first step in the broader accounting process which involves reporting and analyzing data to make business decisions. Many entrepreneurs find that they are wearing too many hats as it is and they just don’t have time to dedicate […]

The Correlation between A Startups Seed Round and Series A Round

Here at The Startup Garage we are often asked, “Has it become harder to raise capital for Startups nowadays?” The answer is, yes and no. On the one hand, the total dollars invested in U.S. startups in 2014 reached its highest point since the dot-com boom in 2000, according to Bloomberg. On the other […]

7 Common Tax Mistakes Made by Startup Businesses

A common misconception among many entrepreneurs is that their startup will not face any tax filing requirements while in the early stages of the business. However, this is not the case. If you incorporate your business or form an LLC you have tax and other government filings that are due, even if you had little […]

Startup Business Funding Report 2014

The past year has been an eventful one for Startup Businesses in their quest to raise capital. Venture Capitalists, Angel Investors, and Peer-to-Peer Crowdfunding soared in 2014, breathing new life into uncertain economy. Venture Capital Roundup According to the PitchBook Platform 88 billion dollars in venture capital was infused into the global economy in 2014. […]

How To Determine Market Traction For Your Startup

The major thing to know about the first few years of funding a startup business is that in order to attract investor capital you must accomplish certain milestones. Accomplishing milestones helps to reduce the risk associated with the startup venture. Investors are constantly assessing risk when evaluating a startup and obviously prefer those that assume […]

Where to find market, industry and competitive analysis?

Welcome to video Fridays from The Start Up Garage A place where Tyler Jensen, The Startup Garage’s founder, answers questions directly from viewers Key Take Aways From Video: 1) One of the first places I start with is industry associations or trade associations for that particular industry that you’re going to be in. 2) Google […]