5 Excellent Startup Tips on Securing a Bank Loan

It’s no secret that securing bank funding for your startup is difficult these days – but it’s not impossible. Give yourself better odds with these 5 simple Startup tips: Write a clear and convincing business plan. Business owners must build a strategy from the very beginning around being “lendable,” so a business plan helps lay […]

Why To Take Caution With Investor “Finders”

There are many service providers that offer to help startups with attracting investors, colloquially referred to as “finders.” While they prefer to be called business brokers or consultants, most finders are either CPAs, insurance brokers, retired executives, or former entrepreneurs. They mostly operate in the Angel landscape, targeting deals between $100K to $2M. Typically, they […]

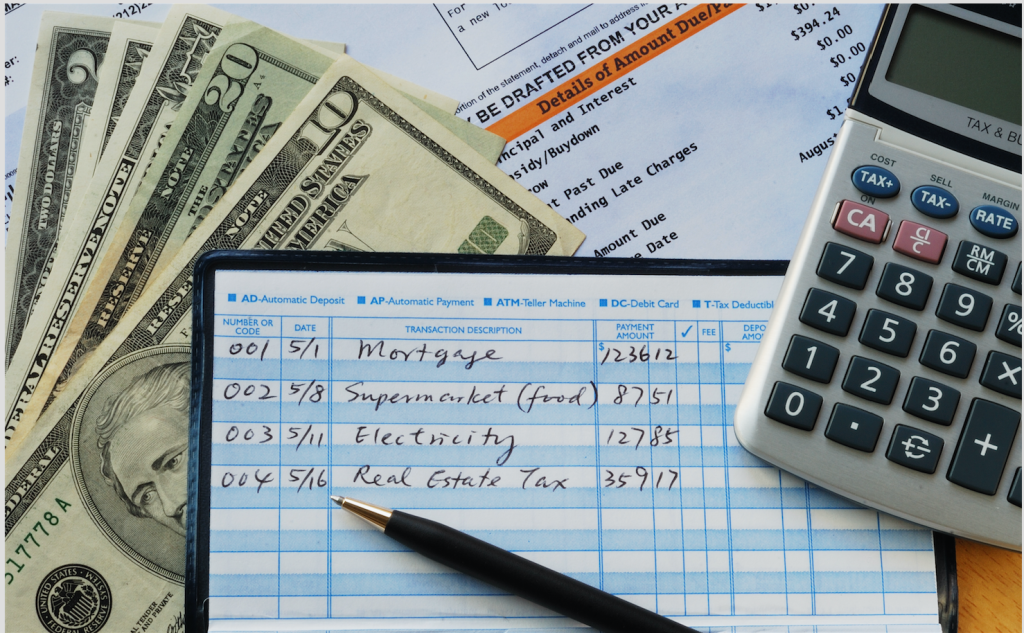

The Importance of Bookkeeping for a Startup Business

Bookkeeping, by definition, is the process of recording a company’s financial transactions and history. It is the first step in the broader accounting process which involves reporting and analyzing data to make business decisions. Many entrepreneurs find that they are wearing too many hats as it is and they just don’t have time to dedicate […]

7 Common Tax Mistakes Made by Startup Businesses

A common misconception among many entrepreneurs is that their startup will not face any tax filing requirements while in the early stages of the business. However, this is not the case. If you incorporate your business or form an LLC you have tax and other government filings that are due, even if you had little […]

Avoidable Legal Dilemmas Every Entrepreneur Should Know

Although the verdict is still out whether or not entrepreneurship can be taught there are a few legal problems that all entrepreneurs can avoid with some proper foresight. 8 Startup Situations Every Entrepreneur Wants to Consider 1) Founder’s Agreement: Most co-founders will have some simple planning conversations at the beginning of the venture. However, it […]

How To Write a Term Sheet For Your Startup

Before we discuss how to write your term sheet, let’s start by defining a term sheet and explaining why it’s useful. What’s a Term Sheet? Technically speaking, a term sheet is a non-binding agreement that demonstrates a basic set of terms and conditions under which an investment is made, typically by either an angel or […]

Hiring the Right Startup Lawyer

You own a young company that is seeking VC, angel or perhaps even seed funding. You want to protect yourself with the right legal documents, ensure that you are taking the right steps and perhaps gain some legal counsel along the way. You turn to your network circles for a recommendation on a good lawyer. […]

Convertible Note Transaction Documents

Many business owners who are unfamiliar with the convertible note process are unaware that of the legal documents needed in convertible debt financing. In addition to the convertible note itself, a startup will need two additional documents: a convertible note purchase agreement and written consent of the startup’s board of directors authorizing the convertible debt […]

The Importance of Copyright Assignments

A copyright isn’t a single right; it is a combination of rights. Copyright owners can transfer some or all of the rights. A full transfer of rights is called a copyright assignment. It’s important for start-ups to get a full copyright assignments for their logo, website, software, etc that is created for the company by independent contractors […]

What You Need To Know About Starting a Non-Profit

Corporations usually acquire funds from government agencies and private foundations. They use these funds to achieve goals that aim at improving social benefits. If you want to fund a non-profit corporation and effect positive changes to the community, check out the following list. It will enable you to gain better understanding about the benefits and […]