5 Reasons Why You Can’t Afford Not to Hire a CFO for your Business

In most cases it takes a very large payroll and budget to staff a full-time CFO however; today, more and more small and mid-sized business owners are capitalizing on the extensive education and training that a part-time CFO brings to the table. For this reason, we are seeing an uptick in the number of business […]

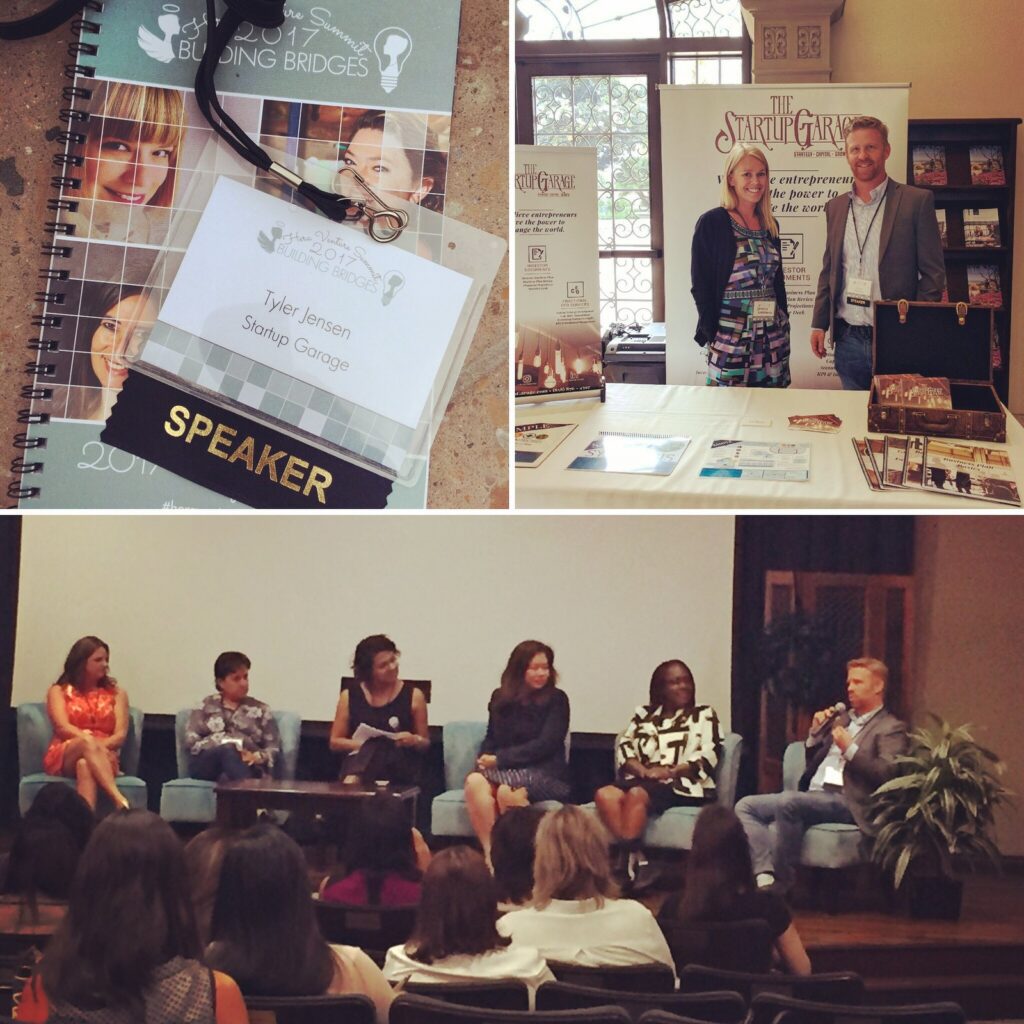

The Startup Garage at Hera Venture Summit 2017

The Startup Garage had the opportunity to be a partner of the Hera Venture Summit for the 2nd year in a row. This annual event, hosted by Hera Hub, Hera Labs, and Hera Fund, brings together experts from both sides of the investment table to share best practices, provide learning opportunities and foster networking. The […]

Rise Up Radio Interview with Tyler Jensen Founder of The Startup Garage

You are listening to James Carmody and Jared Kelley here, in studio for SDriseup.com We are looking to hear stories in your life about local leaders in San Diego. Whether it is the small business owner, your Pastor or leader of your church, your kid’s school teacher or maybe it’s their Little League coach. James: […]

5 Excellent Startup Tips on Securing a Bank Loan

It’s no secret that securing bank funding for your startup is difficult these days – but it’s not impossible. Give yourself better odds with these 5 simple Startup tips: Write a clear and convincing business plan. Business owners must build a strategy from the very beginning around being “lendable,” so a business plan helps lay […]

5 Reasons to Attend The USD V2 Pitch Competition For Entrepreneurs

On Thursday April 28th University of San Diego School of Business will hold an exciting competition in a “Shark Tank” like setting. Top student entrepreneurs from USD and Tijuana will compete for a total of $100,000 in cash and invaluable mentorship and support. The Startup Garage Team Compiled The Top 5 Reasons this is a […]

How to Craft an Effective Mission Statement For Your Startup

When developing a business, an important component of your overall strategic plan is a mission statement. This brief statement declares the purpose of an organization and defines the reason for the company’s existence. It provides the framework to help guide the company’s strategies and actions by spelling out the business’s overall goal. Ultimately, a mission […]

Crowdfunding For Equity: Title III and Equity Crowd Funding 101

What is Equity Crowdfunding? Equity crowdfunding is on the rise after the signing of the Jumpstart Our Business Startups (JOBS) Act was signed by President Obama in April 2012. Simply put, it is a type of crowdfunding that enables broad groups of investors to fund startup companies and small businesses in return for equity. Three […]

How Does A Convertible Note Works For Startups?

A convertible note is an investment instrument intended to provide a startup company with early stage financing. It’s a compromise of sorts, blending the downside protection associated with a loan and capturing the upside potential of selling equity shares. Why are they used? It can be very difficult for investors and entrepreneurs to agree on […]

Top 8 Success Tips For First Time Founders

As a Startup entrepreneur it’s easy for your work to become your life, and 8 years to effortlessly slip by. I founded what has become The Startup Garage in January of 2008 with passion for helping entrepreneurs start and launch companies of impact. Our business, team, and services have evolved, transformed, and changed many times […]

Why To Take Caution With Investor “Finders”

There are many service providers that offer to help startups with attracting investors, colloquially referred to as “finders.” While they prefer to be called business brokers or consultants, most finders are either CPAs, insurance brokers, retired executives, or former entrepreneurs. They mostly operate in the Angel landscape, targeting deals between $100K to $2M. Typically, they […]